The Billion Dollar Food Delivery Wars

Over the past 12 months, food and grocery delivery has been one of the hottest VC sectors. More than $1 billion was invested in 2014 – an almost fourfold increase year-on-year – with a further half a billion dollars invested in Q1 2015, according to CB Insights.

Since the successful IPOs of Just Eat and Grubhub/Seamless a year ago, almost every week has brought fresh news of large-scale funding announcements for existing players, or thelaunch of a new service, making it one of the most competitive sectors currently.

However, competitive does not mean saturated: with online penetration at roughly 1 percent,food and grocery delivery remains one of the largest markets still overwhelmingly offline, and its transition to online/mobile in the coming years will create a wealth of opportunities for entrepreneurs.

As a board member at Deliveroo, I have had the chance to watch the space’s evolution over the past eighteen months, and have come up with three thesis, and three predictions, as to how the current “food delivery war” may play out.

Ubiquitous smartphone penetration has made it possible for anyone to become a courier, and for startups to build delivery fleets at a fraction of the cost incurred previously

1. Convenience always wins: on-demand will take-over the world

The first time I described Deliveroo to my parents, they listened politely for a while, eventually asking: “That sounds nice, but who needs that?”. They assumed that demand would be the issue; that people would simply be happy in perpetuity with the existing set-up of driving to the grocery store to shop for a week’s worth of food, ready to be cooked at home.

The take-up rate of services like Instacart, HelloFresh, JustEat and Deliveroo suggests otherwise. Today, there’s little doubt that people place enormous value on the ability to buy back their time and attention, the key currency of the 21st century.

Changing behaviors have always elicited criticism, if not mockery (this article about the “Shut-In Economy” is a good example), but freeing up time from must-do chores to focus on more productive or enjoyable activities has always been the key driver of human genius and technological progress.

And it turns out that grocery shopping, meal planning and cooking are considered chores by a good chunk of the population – and that any service which offers to free us up from them will receive a lot of organic demand.

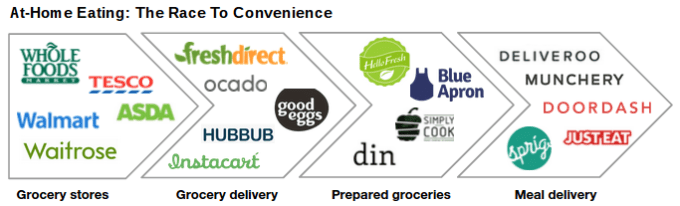

This is why we believe that in the long run, at constant prices, the most convenient option will win. And that the delivery of groceries, recipes or prepared meals will all eat away at the dominance of traditional grocery retailers.

Within this new crop of delivery options, the meal delivery services, with their promise of high quality, ready-to-be-eaten food, delivered in less than 30 minutes, are bound to be the fastest-growing segment of the space, and eventually take market share from other ways of obtaining food.

2. Choice is key: managed marketplaces are the superior model for consumers.

There are three main types of meal delivery services: software-only marketplaces, on-demand marketplaces and fast-food 2.0.

As described below, ordering a meal online involves three main sequential steps: 1. Ordering, 2. Cooking and 3. Delivering.

The first generation of restaurant delivery services (JustEat, Grubhub, Delivery Hero) focused on the first step: they act as a pure software layer that aggregates a fragmented offering of independent restaurants (mainly takeaways), which manage their own fleet of couriers.

These software-only marketplaces’ main selling point to restaurants is to bring a lot of new orders and replace their antiquated phone-ordering system with an optimised Web and mobile platform, that integrates with their kitchen workflow.

As they don’t touch the food itself (neither cooking, nor delivering it), these platforms tend to charge a lowish fee of 10-15%. As any pure software business, they’re highly scalable and have all experienced remarkable growth. But their reliance on the restaurants’ own couriers mean that they are somewhat limited in their offering of cuisines and price points: they have become mainly associated in consumers’ mind with relatively low-end takeaway food (pizza, burgers, Chinese, sushi etc.). It also means that they cannot control and optimize the speed and quality of the delivery.

In our view, the on-demand marketplaces offer the best overall value for customers’ money due to the wider range of food options, through a reliable delivery experience, at no additional costs vs. in-restaurant.

The next generation of restaurant marketplaces (Doordash, Deliveroo, Caviar), which emerged in the past two years, focus on step 1 and 3 of the process: they bring extra traffic and orders to the restaurants, but also manage the delivery for them, through their fleet of independent couriers connected by an Uber-like mobile app.

They are both software and logistics companies and have a very significant amount of operational work to do (couriers’ hiring and training, equipment maintenance, shift planning, etc.).

These on-demand marketplaces are therefore not as easy to scale as the pure-software one, but benefit from stronger barriers to entry and scale advantage: it will be very hard for a new entrant to compete against these optimized networks of restaurants and couriers, once they will have reached maturity in a city. They also charge higher commission, 25-30% on average. Their killer feature is that they can offer a range of restaurants and price points that software-only marketplaces cannot.

The third category of meal delivery startups, which includes Sprig, Maple and Spoonrocket, is defined by CB Insight as “Fast food 2.0″, as they opted for a full integration of the process: they developed their own app through which consumers can order a limited range of meals, reheated in their own fleet of cars as orders come in, and delivered in 15 minutes (as they save on the kitchen preparation time). They trade choice for convenience and a highly curated experience.

In our view, the on-demand marketplaces offer the best overall value for customers’ money due to the wider range of food options, through a reliable delivery experience, at no additional costs vs. in-restaurant.

As they scale, the data they gather on past deliveries will allow them to keep on optimising routes and pick-up/drop-offs patterns, giving them an unassailable technological advantage, on top of the natural network effect of a three-sided marketplace.

3. Demand generation is essential and on-demand marketplaces have unfair advantages

The challenge for food delivery platforms does not lie in the supply. Their value proposition is a no-brainer for restaurants with high fixed costs and low variable costs: every additional order goes straight to the bottom line and helps improve the return on the initial capital investment (kitchen, etc.) and staff, who are working anyway.

Rather it is the demand side of the marketplace that is the most challenging part: restaurants will not want to integrate ten different services into their workflow, and will naturally congregate towards the one or two dominant platforms, who drive the most significant volume of daily orders.

Ability to generate demand is therefore critical and on-demand marketplaces benefit from two unfair advantages. First, as mentioned above, they offer the best value proposition for the consumer, with their large choice and reliable delivery experience. Second, they benefit from two significant competitive advantages in raising consumer awareness:

1. Partner restaurants have a strong incentive to promote the platform both offline and online. Working with popular national brands offers a powerful free advertising channel that software-only or fast-food 2.0 services do not have access to.

2. While coordinating hundreds or thousands of couriers in the street in real time is a massive operational headache, it is also a unique asset. With their branded jackets and delivery boxes, Deliveroo and Doordash couriers act as highly visible advertising panels on wheels, whose reach increases as the company grows, creating a second and very powerful type of network effect.

Assuming these three core thesis come to be validated, here are three predictions for how the food delivery sector could evolve in the future:

1. Software-only marketplaces (a la Just-Eat) will try to bring delivery in-house, while on-demand restaurants (a la Maple) will outsource it.

As on-demand services and last-mile delivery options proliferate, consumers’ expectations will increase rapidly, and currently nice-to-have features like real-time courier tracking will soon become indispensable.

Software-only marketplaces will therefore have to invest a significant amount of resources into offering a competitive experience, either through in-house development, or, more likely, by picking up one or a few of the smaller specialized startups that have popped up in recent months. Expect a lot of M&A activity in the space in the coming 12-to-24 months.

Eventually, they may simply decide to partner with one of the leading logistics companies, which will be able to command better prices at scale through their superior routing algorithms and operational efficiency. Uber, Postmates, or newcomers like OnFleet could all play this role, unless they decide to address consumers directly and to try to compete against the incumbents heads-on.

Meanwhile, Fast-food 2.0 companies will eventually come to the conclusion that building and running their own nationwide delivery infrastructure would require enormous investments, and pose great challenges as competition for couriers heats up, and will instead turn to third-party providers. Some of them may even end up joining on-demand marketplaces to get access to their superior customer base, turning into “virtual” restaurant chains (with no physical locations).

2. On-demand marketplaces will unleash a wave of new “virtual” restaurant chains

This is a trend that is likely to extend beyond fast food 2.0: on-demand marketplaces will soon offer a powerful enough distribution infrastructure (through both very large customer bases and efficient nationwide delivery networks) to spare emerging chefs the hassle and high upfront investment of launching a physical restaurant.

They can instead rent space in industrial kitchens located in their delivery area of choice, and test new concepts on the cheap, the on-demand marketplaces acting as discovery/distribution channels for them – appstores for food.

All the more so that not needing a physical storefront could enable them to cut fixed costs (no more waiting staff, front of house, cleaners, rents, furniture depreciation, etc.) and drastically lower the price of food delivery vs. in-restaurant, growing the market the same way as Uber did with UberX and UberPop.

3. Drones will supercharge this shift and the competitive advantage of on-demand marketplaces

As they grow, on-demand marketplaces will accumulate droves of data about delivery routes, demand patterns (correlation with the weather, the day of the week, sports events, distance to/from payday, etc.) and food preparation characteristics, which will allow them to keep on optimizing their service.

In the long run, this data may prove highly valuable for developing routing algorithms to power fleets of drones, which seem well-suited for food delivery – as the value per unit of weight is high, packages are not excessively heavy or voluminous, the content is not toxic/dangerous, and being able to ignore traffic should give them a significant speed advantage vs. mopeds and bicycles. Drones could also help reduce delivery costs and further enlarge the market.

As with all the other on-demand services, these developments will make living in dense urban areas evermore attractive, accelerating the shift back to a “village economy” well-described by my colleague Terrence Rohan. And as the largest offline sector moves online in the coming years, one thing is beyond doubt – extraordinary opportunities lie ahead.

No comments:

Post a Comment