Summary

Over the past few years, Kroger has had consistent sales and FCF growth, improving margins, and increasing dividends yet still trades at a discount to its peers.

Competitive pressure from online grocers such as AmazonFresh, FreshDirect, and Peapod has been greatly overestimated by investors.

New initiatives such as click-and-collect and 84.51° analytics can drive sustainable earnings growth for many years.

Market pullback largely attributable to international concerns provides excellent entry point as Kroger shares are down ~13% from recent high.

Background

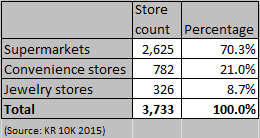

Kroger (NYSE:KR) is the second largest retailer in the US, with a market cap of $33B and 2014 US retail sales of $108B. Kroger operates entirely in the US and primarily competes in the grocery industry.

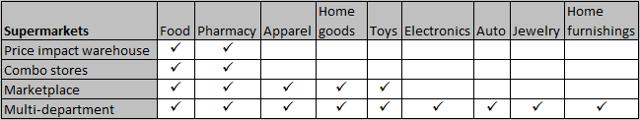

About 1,330 of Kroger's supermarkets and most of its convenience stores have fuel centers. In Q1 2015, fuel accounted for about 13.8% of sales, although this percentage can fluctuate greatly given the volatility of oil prices. Kroger classifies its supermarkets in four categories, which can be best understood by the products they offer.

Combo stores are Kroger's primary food store format; they are supermarkets in the most traditional sense. Price impact warehouses differ in that they are ultra-low cost, warehouse-style stores. Supermarkets are operated under 24+ different banners including Kroger, City Market, Dillons, and Food 4 Less. Kroger has three tiers of private label products (premium, "banner," and value) and a growing Simple Truth label that offers natural and organic products. Kroger operates 37 manufacturing plants and produces about 40% of its private label products in-house.

Profitability

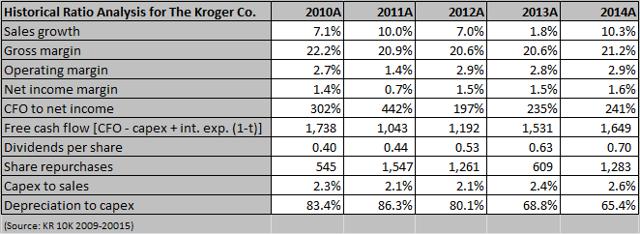

Q1 2015 marked Kroger's 46th consecutive quarter of positive identical supermarket sales growth, excluding fuel. Over the past five years, Kroger's sales growth has averaged 7.2%. Since 2011, gross margin has increased 30 basis points and operating margin has increased 150 basis points, an impressive result considering the slim margins faced by supermarkets.

Over the same time period, Kroger has shown steadily increasing cash flow from $1,043M in 2011 to $1,649M in 2014. Dividends have increased from $0.40/share to $0.70/share and repurchases have averaged about $1B yearly over the past five years. Capex as a percentage of sales is up from 2.1% in 2011 to 2.6% in 2014 and depreciation to capex has decreased from 86.3% to 65.4%. These statistics show management's ability to reinvest for future growth while continuing to return capital to shareholders.

Some other interesting statistics (KR 10-K 2015):

- According to a Nielsen report, Kroger's 2014 market share increased in 18 out of the 20 markets it competes in.

- According to the same study, out of all 15 markets where Wal-Mart (NYSE:WMT) was identified as a top one or two competitor, Kroger increased market share.

- Every Kroger supermarket department and every operating division had positive identical sales in Q1 2015.

Environment

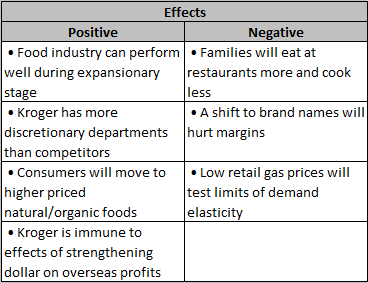

The outlook for the US economy is favorable for the grocery industry. Low consumer borrowing costs, low gas prices, a strong dollar, tightening labor market, and improving consumer confidence will lead to additional discretionary spending on food products and a change in buying habits. Baskets will shift from cheaper to more expensive products, from private labels to brand names, and from processed to natural foods.

Competitive advantage

Recent trends in the grocery industry include the strong performance of discount grocers and specialty organic stores, increased purchases of health and convenience foods, and greater sales of natural and organic products. Kroger has succeeded in this market by offering cheaper organics than specialty stores like Whole Foods (NASDAQ:WFM), but better service and food quality than discount grocers like Wal-Mart, Costco (NASDAQ:COST), and Aldi.

Kroger's ability to capture this middle market is due to control over its supply chain, economies of scale, investments in technology, and focus on customer service. Kroger's numerous store formats, banners, and tiers of private label products allow it to adapt its stores to regional preferences and location-specific needs.

Threats

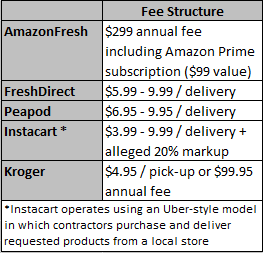

Online sales and home delivery currently make up a small fraction of total grocery sales, but the segment is quickly growing and attracting competition. Major players include FreshDirect, Peapod, Instacart, and AmazonFresh. Although the coming years will see some success stories, I find the competitive pressures on Kroger to be overstated for the following reasons:

- Shelf life, margins, transportation, and product variety make grocery delivery inherently difficult.

- Online grocers have concentrated primarily on wealthier, urban markets especially in the Northeast where Kroger does not compete.

- As of now, fees for home delivery are prohibitively expensive for most Kroger customers.

Some other interesting facts:

- Online supermarkets such as HomeGrocer.com and Webvan first arrived in the late 1990s but most failed during the dot-com bubble.

- Kroger has been testing home delivery in Denver for some time, but has yet to expand it to other regions.

- Kroger has been competing against AmazonFresh in Seattle since 2007.

Acquisitions

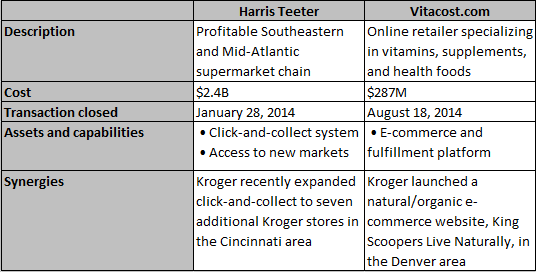

In 2014, Kroger completed two major acquisitions, each giving Kroger access to new capabilities in online retail.

Click-and-collect enables customers to place orders online and pick them up in store or via an express drive-through lane. By the end of 2014, management had the system operating in about 160 Harris Teeter locations.

Rather than run losses to gain market share, Kroger has preferred to develop its online capabilities in select locations. As more customers shift to placing orders online, Kroger can expand their offerings, and beat out new entrants since they already have the technology and infrastructure in place.

Catalysts:

- Increased identical sales as buying trends continue to shift to higher-priced natural and organic foods.

- Larger roll-out of click-and-collect and e-commerce capabilities.

- Store growth, primarily in the price impact warehouse format to compete with discount retailers.

- Increased identical sales from data analytics performed by 84.51° (described by management during their Q1 2015 earnings call as a "game changer").

Valuation

I was initially drawn to Kroger for the following reasons:

- Strong brand name, low beta, entirely domestic operations.

- High growth and low P/E (compared to industry).

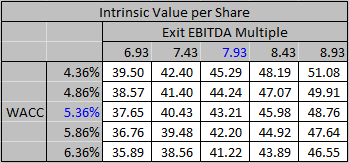

To value this company, I built a three-statement DCF model. I forecasted free cash flows to the firm for the next five years and calculated a terminal value by applying a 7.93 EV/EBITDA multiple to year five forecasted EBITDA. I discounted the cash flows and terminal value using a 5.36% WACC to arrive at my target price.

Using my base-case assumptions, I calculate an intrinsic value per share of $43.21, which represents a 25.56% premium to the current share price. Given the catalysts mentioned above, I see Kroger's price rising to my target within the next 12-18 months.

No comments:

Post a Comment