Food sales draw customers to dollar-stores

POSTED: SUNDAY, SEPTEMBER 7, 2014 12:30 AM

Nine customers were waiting in the Dollar Tree parking lot when a sales clerk opened the door at 9 a.m. Thursday, and numbers 10 and 11 pulled up before the door swung closed.

Annie Vinson and her daughter Jenny Vinson, both just off morning shifts driving school buses, headed right for the food aisles, where they filled a basket with items including french fries, French toast sticks and French onion dip.

“Look!” Annie Vinson said, holding up a bag of frozen bell pepper strips. “It’s a dollar, and look how big it is.”

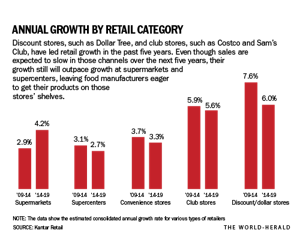

Customers like the Bellevue mother-daughter team, who seek out deals on groceries no matter the type of store, have helped dollar stores become the fastest-growing brick-and-mortar retailers today, largely because of growing food sales, according to Kantar Retail analysts. Dollar store sales have grown twice as fast since 2009 as sales at supermarkets or supercenters, according to Kantar.

Food manufacturers like Omaha’s ConAgra Foods are now pushing to get more products on dollar store shelves, as stores like the South Omaha Dollar Tree where the Vinsons visited expand grocery aisles and add frozen food sections to take advantage of the demand.

ConAgra CEO Gary Rodkin this summer suggested the company may have been late to the party, one reason why the manufacturer’s fiscal 2014 sales were below expectations.

“We have been underdeveloped here,” Rodkin told analysts, “and simply capturing our fair share of these faster-growing retail outlets, specifically club, dollar and C-store (convenience stores), will provide a meaningful boost.”

One challenge is that selling more food in these alternative retail outlets is not as simple as persuading retailers to stock the same products that are sold at a Hy-Vee or a Walmart. Walmart is ConAgra’s biggest customer, representing 17 percent of net revenues, and much of ConAgra’s products and packaging are designed to fit Walmart’s super-sized shelves and storerooms.

The typical Dollar Tree is 1/16th the size of the typical Walmart Supercenter. It doesn’t have room for big pallets and packages, ConAgra Senior Vice President Bob Biddlecombe said. He oversees ConAgra’s “channels” business — selling to retailers including Costco, Sam’s Club, dollar stores and convenience stores.

Biddlecombe agreed with Rodkin that, “We needed to be faster in adapting to this channel business.”

Some competitors have moved more quickly. Heinz in 2012 introduced a 10-ounce, 99-cent pouch of ketchup for the discount store market. Heinz also sells a three-pack of its ketchup at Costco, with a total weight of more than 8 pounds.

But Biddlecombe said ConAgra is in the right place to take advantage of future growth. And it’s not too late, Biddlecombe said.

“Even though we appear to be pulling out of this recession, there is a new normal out there for how consumers shop,” he said. “They’re not going to walk away from being very value-conscious.”

ConAgra has several brands that already are “value-oriented” and are in the “sweet spot” pricewise for dollar store customers, Biddlecombe said, such as the single-serve Banquet meals in Dollar Tree’s freezer case.

ConAgra is also creating new products and redesigning existing ones just for these supermarket alternatives, he said. Not only is it downsizing or upsizing familiar products accordingly — for example, single-serve packs of Orville Redenbacher’s popcorn sold in gas stations — it also is developing products specific to each channel, such as an organic olive oil version of Pam cooking spray for Costco.

Biddlecombe said the manufacturing and distribution capabilities that ConAgra gained in the 2013 acquisition of private-label food maker Ralcorp will prove useful in serving dollar and club stores. Products without major-label marketing campaigns behind them can be sold for less. Ralcorp’s products included sauces, pasta, cereal, crackers, cookies and snack foods.

Though stock analysts are second-guessing the Ralcorp acquisition because the division’s troubles have dragged down ConAgra’s profits, Biddlecombe said the private-label capabilities will help ConAgra expand its presence in Costco, through the Kirkland store brand, especially as Costco sets its sights on international growth.

“It’s really opened up our opportunity to expand into all these classes of trade a lot differently than we have previously,” he said.

Retail analysts agree the window hasn’t shut on the opportunity.

“There is absolutely room for growth,” said Sarah Al-Tukhaim, club store analyst for Kantar Retail.

ConAgra can be successful with club stores by developing products exclusive to each retailer. Warehouse stores like Sam’s Club and Costco cater to small businesses and higher-income households that can afford to pay an upfront membership fee to buy in bulk. Those buyers are looking for something unique.

“You do see a much bigger need to innovate,” she said.

On the other end of the income scale, even though reports show consumer confidence is growing, “There will always be low-income shoppers, there will always be shoppers who live paycheck to paycheck,” said Mike Paglia, a Kantar analyst covering discount and dollar stores.

“The Family Dollars and the Dollar Generals of the world will continue to be there to met their needs. ... This is still a very strong, growing channel of trade.”

Dollar stores have grown to about 24,500 stores, by about 10,000 in the last decade, Reuters reported. Combined sales of Family Dollar, Dollar Tree and Dollar General have grown to $35 billion.

The stores “rode the wave” of the 2008 Great Recession, and today are faced with the challenge of how to continue the growth, Paglia said.

The stores are adjusting merchandise mix to generate both high sales volume and high margins. Deals on food can bring in customers who might then buy a higher-margin holiday decoration, and several discounters are adding food space, which could be a boon for ConAgra.

For example:

» Dollar Tree said that recent expansions of food products, among other categories, are boosting same-store sales and that the retailer would be adding frozen and refrigerated cases to more stores this year.

» Family Dollar said in July that refrigerated and frozen food sales have been “robust” and the company is adding beer and wine sales this year. In March, the chain added 400 new food items, mostly national brands.

» Dollar General is adding about 100 larger “Dollar General Plus” stores this year, with more room for refrigerated and frozen food, and also is adding new $1 food items under its Smart & Simple private label. The company also is treading into grocery store territory with its Dollar General Markets, which sell fresh produce and meats and in some locations include a gas station. Stores are planned in Loup City and Hastings.

» Big Lots said in August it has revamped food departments at all its 1,491 stores, with more brand names and better-designed signs. Big Lots already carried ConAgra brands, including Hunts, Chef Boyardee and Fiddle Faddle, but has added six more, including Orville Redenbacher’s, Healthy Choice and Rotel.

Omaha customers said both deals and convenience bring them to discount stores for food.

“I shop here because it’s convenient,” said Sheena Robinson, at Family Dollar on Saddle Creek Road with her 4-year-old daughter. She lives nearby, and though she makes larger stock-up grocery trips to Walmart, she comes to Family Dollar for the few items she needs during the week — what retailers call “fill-in trips.”

That’s even though the prices are a little bit higher, Robinson said, like the ConAgra Banquet frozen meal she bought for $1.30 that sells for around $1 at larger stores.

Other families trade convenience to save a few dollars.

Annie Vinson, at the Dollar Tree, said her daughter will shop at five different stores each week, just to get the best price on each item. Family members, for example, might go to Baker’s for a deal on meat, Walgreens for milk and Walmart for other food.

With so many stores competing for her food budget, Vinson said, “It’s become a thing where you really have to do your job” to research prices.

No comments:

Post a Comment