Deflation rules in 2016

ERS expects supermarket prices to decrease between 1.25 and 0.25 percent, marking first year since 1967 that retail food prices could reflect annual deflation.

By Store Brands, Stagnito Business Information

The USDA’s Economic Research Service (ERS) expects supermarket prices to decrease between 1.25 and 0.25 percent, marking the first year since 1967 that retail food prices could reflect annual deflation.

ERS lowered the forecast because of recent declines in prices for beef and veal, poultry and eggs. Lower transportation costs, a result of deflated oil prices, as well as the strength of the U.S. dollar have placed additional downward pressure on food prices in the first half of 2016, according to ERS.

“A strong U.S. dollar makes U.S. goods less desirable to foreign markets, leaving more potential exports on the domestic market,” the ERS stated in a report on its website.

Supermarket prices remained flat from September to October and are 2.3 percent lower than October 2015 prices, according to the USDA’s Economic Research Service (ERS). Retail food prices were flat or decreased for eight of the first 10 months of 2016.

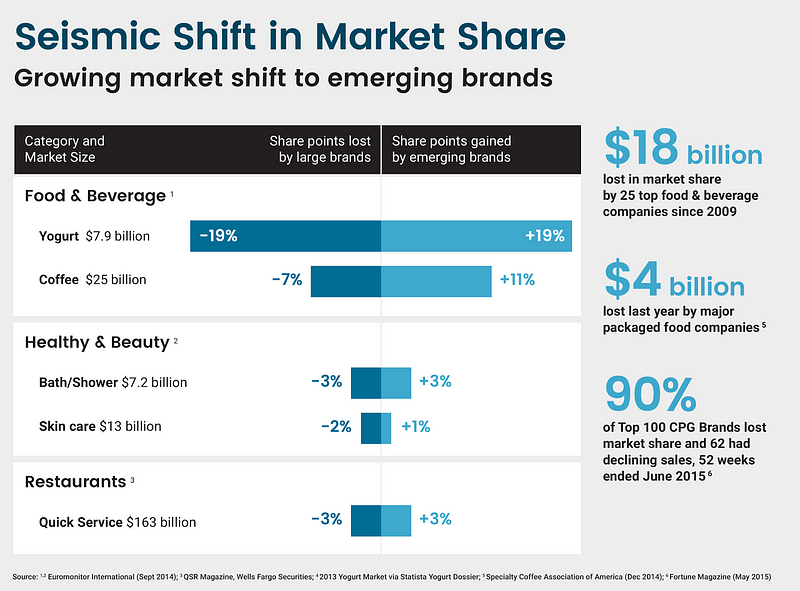

Meanwhile, restaurant prices were up 0.1 percent in October and were 2.4 percent higher for the month when compared to October 2015.

“[Restaurant] prices have been rising consistently month-over-month due, in part, to differences in the cost structure of restaurants versus supermarkets or grocery stores,” according to ERS. “Restaurant prices primarily comprise labor and rental costs, with only a small portion going toward food. For this reason, decreasing farm-level and wholesale food prices have had less of an impact on restaurant menu prices.”

Looking ahead to 2017, supermarket prices are expected to rise between 0.5 and 1.5 percent, according to ERS.

“Despite the expectation for declining prices in 2016, poultry, fish and seafood, and dairy prices are expected to rise in 2017,” ERS stated. “These forecasts are based on an assumption of normal weather conditions throughout the remainder of the year; however, severe weather or other unforeseen events could potentially drive up food prices beyond the current forecasts. In particular, the drought in California could have large and lasting effects on fruit, vegetable, dairy, and egg prices. Also, a stronger U.S. dollar could continue to make the sale of domestic food products overseas more difficult. This would increase the supply of foods on the domestic market, placing downward pressure on retail food prices.”