What Deflation? The Price Of Ground Beef Has Doubled Since The Last Financial Crisis

Submitted by Tyler Durden on 03/27/2015 20:45 -0400

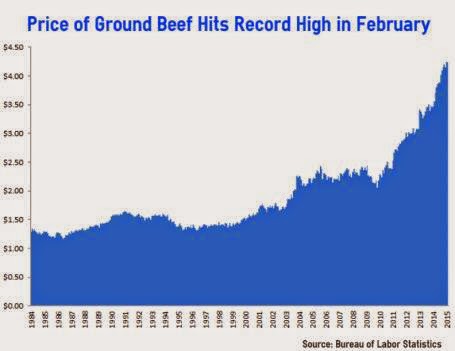

Since the depths of the last recession, the price of ground beef in the United States has doubled. Has your paycheck doubled since then? Even though the Federal Reserve insists that we are in a “low inflation” environment, the government’s own numbers show that the price of ground beef has been on an unprecedented run over the past six years. In early 2009, the average price of a pound of ground beef was hovering near 2 dollars. In February, it hit a brand new all-time record high of $4.238 per pound. Even just 12 months ago, the price of ground beef was sitting at $3.555 per pound. So we are talking about a huge increase.

And this hits American families where they really live. Each year, the average American consumes approximately 270 pounds of meat. The only nation in the world that eats more meat than we do is Luxembourg. If the paychecks of American workers were going up fast enough to deal with this increase, it wouldn’t be that big of a deal. But of course that is not happening. In an article just last week, I showed that real median household income is a couple thousand dollars lower now than it was during the depths of the last recession. The middle class is being squeezed, and we are rapidly getting to the point where burgers are going to be considered a “luxury” item.

The following chart was posted by the Economic Policy Journal on Wednesday, and it incorporates the latest data from the Bureau of Labor Statistics. When I first saw it, I was rather stunned. I knew that the price of ground beef had become rather outrageous in my local grocery stores, but I had no idea just how much damage had been done over the past six years…

The biggest reason why the price of ground beef has been going up is the fact that the U.S. cattle herd has been shrinking. It shrunk seven years in a row, and on January 1st, 2014 it was the smallest that it had been since 1951.

The good news is that the decline appears to have stopped, at least for the moment. According to the Wall Street Journal, the size of the U.S. cattle herd actually increased by 1 percent last year…

The U.S. cattle herd expanded in 2014 for the first time in eight years, offering hope to consumers that beef prices could start to subside after soaring to a series of records.The nation’s cattle supply increased 1% in the year through Jan. 1 to 89.8 million head, according to data released Friday by the U.S. Agriculture Department, reversing a steady decline fueled by prolonged drought in the southern U.S. Great Plains and industry consolidation that encouraged many ranchers to thin herds.

But an increase of 1 percent is just barely going to keep up with the official population growth rate. If you factor in illegal immigration, we are still losing ground.

And if we have another major drought in cattle country this summer, the cattle herd is going to start shrinking again.

In addition, the price of food overall has been steadily rising for years. Here is a chart that I shared the other day…

It boggles the mind that the Federal Reserve can claim that we are in a “low inflation” environment. Anyone that goes grocery shopping feels the pain of these rising prices every time that they go to the store.

In the list that I put together yesterday, I included the following statistic…

Almost half of all Americans (47 percent) do not put a single penny out of their paychecks into savings.

One of the primary reasons why so many Americans are not saving any money is because many families simply cannot save any money. Their paychecks are stagnant while the cost of living just keeps going up and up.

There simply are not enough “good jobs” out there anymore. Our economy continues to bleed middle class jobs and the competition for the jobs that remain is quite intense.

Do you know what the two most common occupations in America today are?

According to the Bureau of Labor Statistics, they are “retail sales clerk” and “cashier”.

And of course neither of those “occupations” pays even close to what is required to support a middle class family.

Because the quality of our jobs has declined so much, there are millions of American families today in which both the mother and the father are working multiple jobs in a desperate attempt to make ends meet each month.

But don’t worry, the Federal Reserve says that we are nearly at “full employment“, and Barack Obama says that everything is going to be just fine.

Actually, the truth is that things are about to get a lot worse. At this point, we are even getting pessimistic numbers out of the Federal Reserve. Just this week we learned that the Fed is now projecting that economic growth for the first quarter of 2015 will be barely above zero…

From almost 2.5% GDP growth expectations in February, The Atlanta Fed’s GDPNow model has now collapsed its estimates of Q1 GDP growth to just 0.2% – plunging from +1.4% just 2 weeks ago. The reality of plunging capex and no decoupling is starting to rear its ugly head in the hard data and as the sun warms things up, weather will start to lose its ability to sway sentiment.

We are at a turning point. The bubble of false stability that we have been living in is rapidly coming to an end, and when people start to realize that another great economic crisis is coming there is going to be a lot of panic.

And as far as food prices go, they are just going to keep taking a bigger chunk out of all of our wallets.

As high as prices are already, the truth is that your food dollars are never going to go farther than they do right now.

So let us hope for the best, but let us also get prepared for the worst.

No comments:

Post a Comment