Summary

- WFCF operates in one of the fastest-growing niches of the food industry: supply chain auditing.

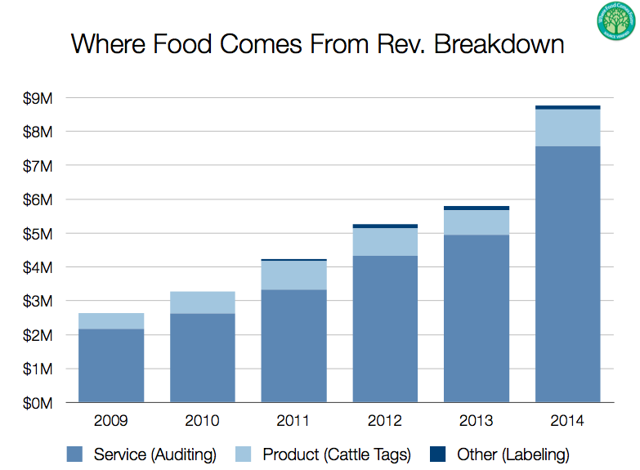

- The company has built a strong moat with 30+ food verification services, and is beginning to ramp monetization through product and labeling revenue.

- WFCF has a proven track record of creating shareholder value through a profitable core business, organic growth and accretive acquisitions to expand its product line.

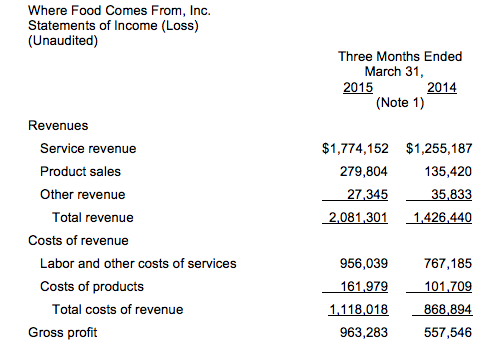

- Revenue increased 46% YoY in Q1 as momentum and growth continue.

Thesis Overview

Where Food Comes From (OTCQB:WFCF) is the nation's leading third-party traceability and certification company for the food and agriculture industries.

(Screenshot from Where Food Comes From website)

Founded by John and Leann Sanders 20 years ago, Where Food Comes From is based in Castlerock, Colorado. The company has a history of profitable operations and strong organic growth. This combination, in tandem with a successful acquisition strategy and limited dilution has led to phenomenal shareholder returns.

Over the past 5 years, the shares have risen more than 1,000%. In addition to creating significant shareholder value, management has positioned the company for continued long-term success.

I believe the inflection point has long passed, and the demand for transparency and information on where food is coming from is a mega-trend. People want to know what they are eating and the story behind it.

Where Food Comes From has multi-bagger potential in the coming years, as it profitably capitalizes on this opportunity.

Core Business: Food Supply Chain Auditing

According to Where Food Comes From's May Investor Presentation, the company currently covers audits for beef, pork, dairy, lamb, bison, produce, dairy, eggs and grain. Future areas of coverage will be seafood, beverages and more produce.

It's no secret that the company wants to own the food auditing market, and it has been pursuing that goal aggressively.

Food auditing is ~$100M business in the US right now, and growing rapidly. Where Food Comes From dominates the niche, and is continually expanding by taking market share and buying out smaller competitors.

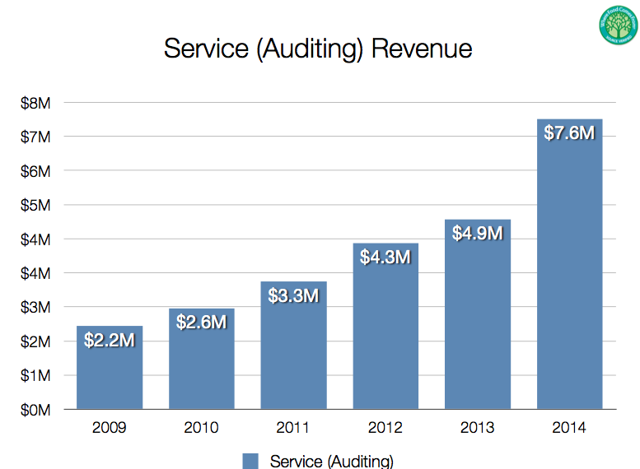

The track record of growth in this segment has been impressive. Auditing revenue is recurring, and profitability is improving as economies of scale kick in.

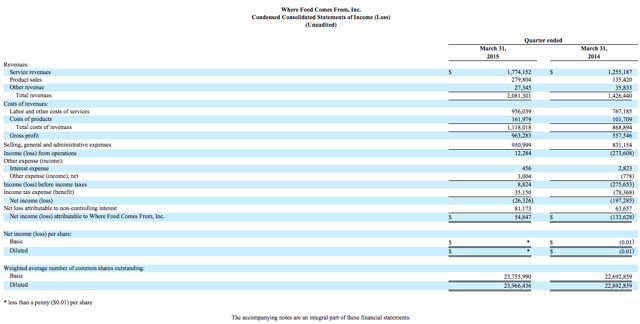

This screenshot from Where Food Comes From's Q1 report shows service gross margins rising from 38.9% in Q1 2014 to 46.1% in Q1 2015. In part, this can be attributed to the company's ability to offer over 30 differentverification services. These include USDA Grass-Fed Beef, Gluten-Free Certification, Whole Foods Egg Laying Standards, USDA Organic, Non-GMO Project Verification, and many more. Bundling products and auditing them in the same visit can boost Where Food Comes From's margins and help customers save money/time.

In addition to scale boosting gross margins, it makes the company a potential partner for very large food chains. A great example of this is Where Food Comes From's new initiative to be the auditor for McDonald's (NYSE:MCD) sustainable beef pilot program in Canada.

It's no secret that McDonald's public image is struggling, and it is beginning to take action to reverse public sentiment. McDonald's and Where Food Comes From have been working hard on this pilot program, and are set to roll out its next phase in 2016.

If expanded to the US, or even fully in Canada, this would be a major driver of audits for Where Food Comes From. As the industry's leading auditor, it is possible that the company will also be a beneficiary of other chains looking to move towards sustainable food production.

Growth Initiative I - Cattle Tag Products

Where Food Comes From is specialized in meat products, and beef in particular.

Cattle tags are a product that the company can offer as an add-on for its core auditing customers. Tagging cattle takes verification to the next level and provides an even deeper level of transparency to end-consumers.

(This picture is from a GreenBiz article about the WFCF/MCD Sustainable Beef Pilot Program)

Currently, only a fraction of cattle in the US are tagged. There are approximately 90M cattle in the US, of which 25-30M are "terminal" and used for food on an annual basis. Overall, just 750K-1M of all cattle are tagged, representing penetration of about 1%.

Where Food Comes From estimates that it has 85% of the domestic beef auditing market, and would therefore be the main beneficiary from increased tag sales. If penetration rises to just 20% of all US terminal cattle, it could represent $10M+ in annual revenue for the company.

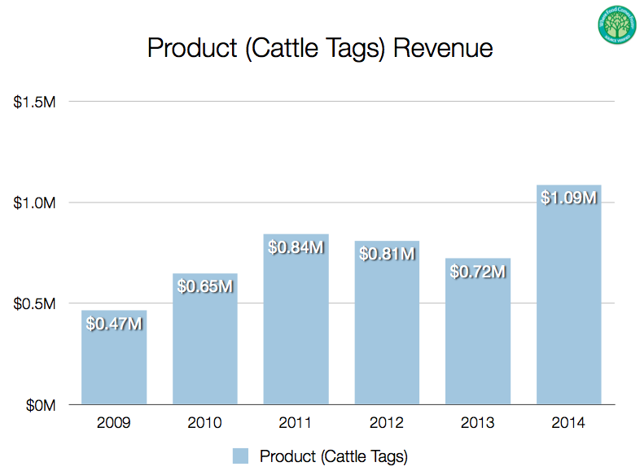

In the long run, product revenue has been growing, but not consistently. However, it looks like sales are beginning to ramp steadily, after a record year in 2014 and year-over-year growth of 107% in Q1 2015.

The main drivers of this growth have been ADT regulations and beef suppliers giving in to demands of consumers for a more transparent process. Neither of these trends are going away.

away.

away.

away.

As additional certification services are created and quality standards rise, the company's auditing business becomes even more valuable. Cattle tags may be the first of many ancillary products Where Food Comes From can sell to its growing audit customer base.

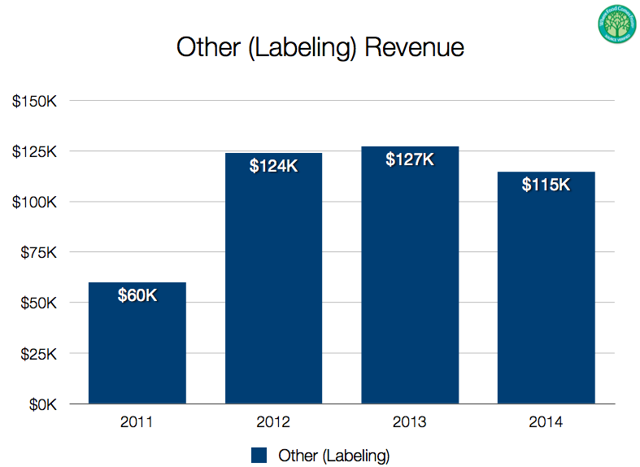

Growth Initiative II - Where Food Comes From Labeling

This has been the holy grail of Where Food Comes From's business model, and may eventually be the most lucrative part of the company.

By creating its own proprietary label, Where Food Comes From is going all the way from farm to the consumer. Margins in the labeling business are much higher, and offer entrance into a much bigger end-market. Management estimates the labeling opportunity is at $2.7B, and growing.

Growth has been disappointing since the product's launch in 2011, but things may be about to turn a corner.

Growth in late 2014, and early 2015 has been slowed down significantly by a change in beef suppliers for the company's main labeling customer, Heinen's. This issue is in the process of being resolved, and Heinen's began generating labeling revenue again in Q1.

In addition to Heinen's coming fully back on-line throughout the rest of 2015, Where Foods Come From is expanding rapidly with several other labeling partners. During Q1, the company implemented 20 new grocery customers, representing over 200 total stores.

Valuation

With approximately 24M shares outstanding, Where Food Comes From has a current market capitalization of $63.6M. In 2014, the company recorded $8.8M in sales and $340K in EBIT. This puts the trailing P/S ratio at 7.2X and the trailing P/EBIT ratio at 187X. Although these numbers seem stretched, on a forward basis, the company looks dramatically more attractive.

In Q1, revenue grew at 46%, and extrapolating that for the rest of the year leads us to a projection of $12.8M in 2015 sales.

(WFCF Q1 2015 10Q Filing)

With operating margins improving dramatically, we are likely to see nearly $1M in EBIT this year. That brings the 2015 valuation multiples to a more reasonable 5X P/S and 64X P/EBIT.

Although these ratios are expensive, I am happy to buy Where Food Comes From at these levels. Operating margins were 16% in 2011, compared to just 4% in 2014. Over the long term, I believe the margins will trend back to 15%+ as scale improves, and one-time acquisition-related expenses are not a factor. With these assumptions in place, the company has the potential to produce $2.4M in EBIT in 2016 (assuming 15% margins on $16M in sales), in my opinion. Based on those figures, Where Food Comes From trades at far more attractive 26.5X 2016 P/EBIT.

The company has a very clean balance sheet, with no debt and ~$3M in cash as of Q1. In the past, Where Food Comes From has done an excellent job of making small accretive acquisitions. This should continue as its core operations begin producing significantly higher free cash flow.

Conclusion: The Future Of The Food Industry

I am a long-term growth investor looking for great management teams, profitable business models, and a runway for decades of growth. Where Food Comes From fits the bill, and has built an incredible company that is leading the food industry in the right direction.

Consumers' awareness surrounding what we eat is growing exponentially, and transparency in the food business is here to stay. Technology is allowing for better tracking/verification capabilities and increased visibility to end-customers.

If Where Food Comes From continues to expand its certification services and has success with its new product and labeling initiatives, profits will increase exponentially. In the near term, shares are valued at a slight premium, reflecting the company's dominant position in the food industry's fastest-growing niche.

Over the long term, I believe Where Food Comes From will be a very attractive investment at today's price of $2.65 per share.

No comments:

Post a Comment