Revisited: Whole Foods, Wal-Mart And The Coming Commoditization Of Organic Grocers

Summary

Two years ago I wrote an article examining the organic grocery industry, and questioning the viability of the growth expectations priced into Whole Foods' stock.

Since then, Whole Foods has seen its growth slow significantly, largely driven by the massive increase in competition.

While Whole Foods is still a solid company, its stock is unlikely to see a return to the premium growth valuation multiples it once enjoyed.

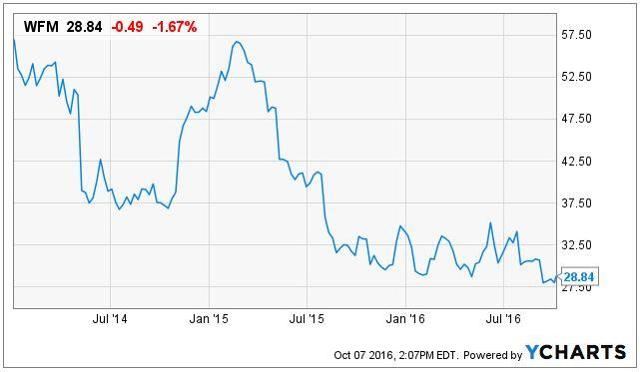

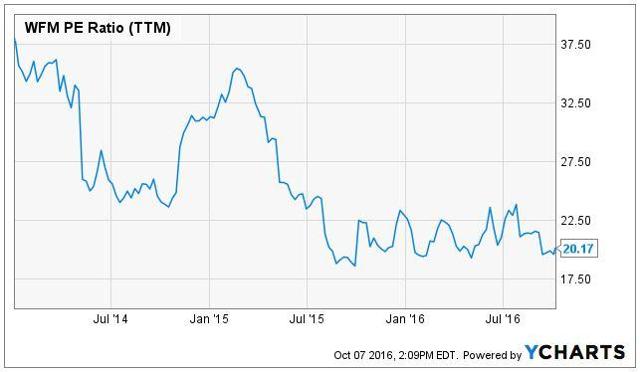

In July of 2014, I wrote an article here on Seeking Alpha titled, Whole Foods, Wal-Mart and The Coming Commoditization of Organic Grocers, in which I hypothesized that a coming shift in the organic grocery industry would spell trouble for Whole Foods Market's (NASDAQ:WFM) stock price. At the time, their stock had recently tumbled from the $60s down into the high $30s, leading many bulls to excitedly declare a buying opportunity. I presented a counter-argument to this case, cautioning that the premium valuation multiples that WFM had historically traded at had become outdated and that the stock had additional room to fall.

Most, if not all, of my article was admittedly speculative and very much qualitative in nature. After all, I was making an educated guess at what the long-term future of a major industry would look like. Two years later, I believe that enough time has passed to check in and see how things are playing out.

While I encourage you to go read (or re-read) my initial article, my argument can be summarized as follows:

- The entry of Wal-Mart (NYSE:WMT) into the organic grocery industry in 2014, while not posing a direct threat to Whole Foods, signaled a significant shift in the broader industry. What was once a small niche market was quickly becoming a mainstream norm.

- Whole Foods would remain successful from a business standpoint.However, the growth expectations historically factored into their stock price would prove inaccurate. Industry-wide growth would be driven by demographics that are much more price-sensitive than the traditional Whole Foods shopper.

- While investors were accustomed to WFM trading in the 30-40x P/E range, buying below that range didn't necessarily make it a bargain.

In short, I believe that my thesis is playing out as predicted and will continue to do so for the foreseeable future. Whole Foods' management seems to agree, taking time during recent conference calls to acknowledge the increased competition and introduce a set of new initiatives in response. While management is certainly taking action to address the situation, it remains to be seen if this will be enough to boost the stock price back to the premium valuation levels it once enjoyed.

The historical "bull case" for WFM has always seemed to rest on two major pillars: First, Whole Foods will eventually expand to management's stated goal of 1,200 stores (more than double their current store count). Second, Whole Foods will maintain their premium pricing power within the industry. I've long conceded that if both these points hold true over the long run, WFM is a must-buy at current prices. However, I have long questioned the long-term viability of these two pillars, and believe they are currently beginning to crumble.

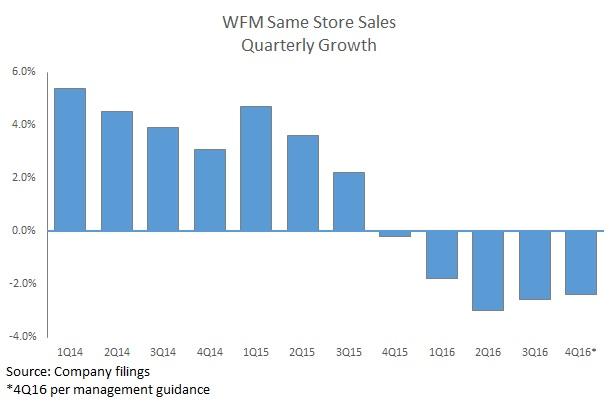

Looking at Whole Foods' business performance over the past two years, it's easy to see why the stock price has struggled. Same-store sales, once averaging 8% annually over a 15-year period, have fallen off a cliff. After steadily declining through 2014 and 2015, the metric went negative in Q4 of 2015 and is expected, per management guidance, to remain negative through at least the end of 2016. In their most recent quarterly earnings call, CEO John Mackey acknowledged that competition was taking its toll:

"[C]ompetition, I mean it's not a big secret, is it? There's a lot more competitors in the marketplace and there's a lot of new formats in the marketplace, from home meal replacement to meal kits, fast casual restaurant growth. More entrants in the natural and organic food space. The mainstreaming of natural organic, which has been well reported. These are all factors.[…] We probably feel the brunt of it, as there's a bit of a regression to the mean as we lose customers from a convenience standpoint. People don't drive as far as they used to drive, because there's good enough alternatives in many cases close by to them.So people may not be driving as frequently as far as they used to, because they can stop by a Kroger or an HEB or a Wegmans to get products that they can use to only be able to get Whole Foods… So, I think there's no sense in denying it."

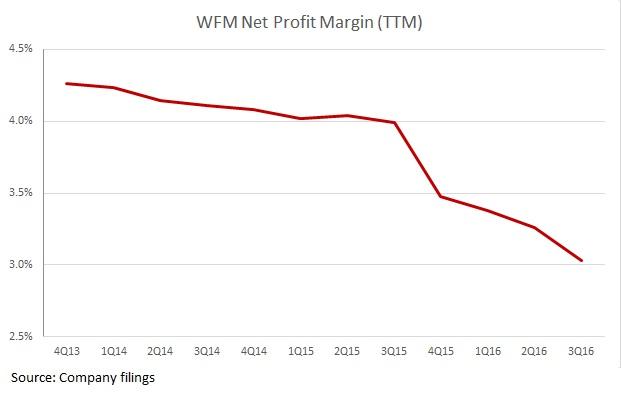

Along with the decline in same-store sales, Whole Foods has also seen their margins shrink significantly over the past two years. On a trailing twelve-month basis, gross margins have eroded from 35.8% to 34.4%, and net profit margins have dropped from 4.3% to 3.0%. To be fair, these margins are still quite impressive when compared with many other grocers, but they are indicative of management efforts to become more competitive on pricing.

Back in 2014, a major cause for concern among Whole Foods investors was the entry of Wal-Mart into the organic grocery industry. The overwhelming consensus, which I agreed with, was that Whole Foods and Wal-Mart were completely different companies catering to completely different demographics, and that it was absurd to think that Whole Foods customers would suddenly defect to Wal-Mart for lower prices.

However, in my initial article, I argued that while Wal-Mart's low prices did not pose a direct threat to Whole Foods, it did signal a massive shift in the broader organic grocery industry. While Whole Foods and Wal-Mart represent the two extreme ends of the industry, there are numerous other competitors at various points in-between. These include other mass retailers (Target (NYSE:TGT), Costco (NASDAQ:COST), etc.), traditional supermarkets (Kroger (NYSE:KR), Safeway (NYSE:SWY), Publix (OTC:PUSH), etc.) and "2nd tier" organic grocers (Trader Joe's, Sprouts (NASDAQ:SFM), Fresh Market (NASDAQ:TFM), Fairway (NASDAQ:FWM), etc.). I believe this is an important way to think of the organic grocery industry due to the demographics that are driving industry-wide growth. A recent report from the USDA states that:"organic products have shifted from being a lifestyle choice for a small share of consumers to being consumed at least occasionally by a majority of Americans." While the loyal Whole Foods "lifestyle" shopper may not be overly sensitive to price, the majority of Americans certainly are, and they are the ones who are driving the broader industry growth. While Whole Foods may not need to be concerned with how their prices compare to Wal-Mart, they do need to be concerned with how their prices compare to competitors like Trader Joe's or Sprouts.

In fact, on the WFM 2Q16 earnings call, company President & COO A.C. Gallo admitted that they were actively monitoring competitor pricing and cutting prices when necessary:

"We noticed last - I think starting in November that Trader Joe's had lowered prices in certain items, in certain markets. And we monitor Trader Joe's and other competitors very closely, and we make sure we have certain price bandwidth that we make sure that we follow with them. And so in key items that we saw Trader Joe's change pricing on, we changed pricing as well on certain items to make sure we maintained our proper bandwidth to them."

To give management credit, they've recognized that the competitive landscape has become a lot more challenging, and they are taking steps to make sure the company remains an industry leader. In the Q4 2015 conference call, CEO John Mackey acknowledged that the competitive landscape was shifting, and laid out a 9-step plan for adapting. These steps include reducing operational costs, an increased focus on private-label brands, increasing sales and promotional activity, and launching a new brand of small-footprint "365" stores.

These new initiatives will likely have a positive impact, and Whole Foods will likely continue to operate as a successful company. However, it is unlikely that these initiatives will return the company to their high-flying growth numbers of the past. Investors expecting an imminent return to the $50s or $60s may be better off dumping their shares in the compost pile instead.

No comments:

Post a Comment