Amazon Prime will be in more than half of US households by year's end

- Amazon's latest Prime Day added more Prime subscriptions over a 24-hour period than ever before.

- That push is helping to drive membership over the 50 percent threshold, Cowen says.

- Back-to-school shopping and the 2017 holiday season are expected to give the internet giant another welcome boost.

- Amazon Prime has room to grow with lower-income shoppers, which hold the smallest percentage of memberships today.

Getty Images

Jeff Bezos

Jeff Bezos is reportedly closing in on surpassing another major milestone.

Amazon's Prime program — which has boasted impressive growth in recent years — should finally be in more than 50 percent of American homes before the year is over, Cowen and Co. has predicted.

According to the firm's monthly survey of 2,500 U.S. consumers, about 49 percent of respondents already had a Prime membership this July.

Amazon's latest Prime Day, which added more Prime subscriptions over a 24-hour period than ever before, is what will drive membership over the 50 percent threshold, Cowen analyst John Blackledge said in a note to clients Tuesday.

Back-to-school shopping and the 2017 holiday season are expected to give the internet giant another welcome boost.

As Amazon grows its offerings within Prime — such as Prime Now, Prime Pantry, Prime Video and Prime Music — a membership is looking more and more appealing to consumers. "Prime has maintained healthy growth despite its scale," Blackledge said. A "constantly evolving value proposition" helps, too. And Amazon likes to keep things fresh.

Important to note, Amazon has historically kept its number of Prime subscribers close to the vest. But Blackledge and his colleagues at Cowen estimate that there were more than 54 million U.S. Prime subscribers by July of this year, up from the 46 million subscribers that Cowen suggested the same time a year ago.

A representative from Amazon didn't immediately respond to CNBC's request for comment on these numbers.

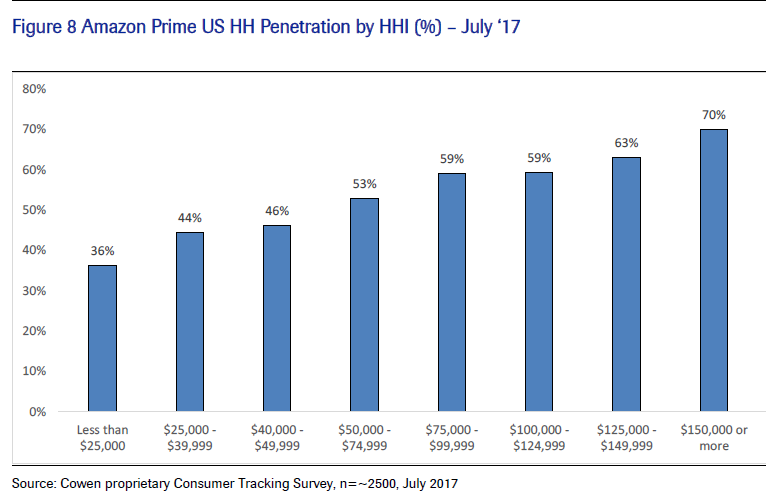

Amazon Prime membership also notably remains lowest among households that make less than $25,000 per year, according to Cowen. That being said, Amazon has plenty room to grow with lower-income shoppers.

Source: Cowen and Co.

Amazon Prime remains the "most critical driver" of [Amazon's] retail business over the long term, Blackledge said.

Amazon's stock on Tuesday was hovering around $990 per share, having reached the $1,000 mark earlier this year. The shares have climbed more than 29 percent over the past 12 months but have traded off more recently after an upsetting second-quarter earnings miss.

Amazon Web Services remains the company's main growth driver, climbing 42 percent year over year and generating $916 million in operating income. But retail sales look to be a growing part of Amazon's business, as evidenced by a booming Prime penetration.

No comments:

Post a Comment