Alibaba: Investing For Future Growth?

Summary

Alibaba is aggressively experimenting with physical stores as part of its New Retail strategy.

Offline stores still account for close to 85% of the total retail sales in China.

Building a strong physical presence through malls, supermarkets and convenience stores will help Alibaba increase customer loyalty for its ecosystem.

With the current strategy, Alibaba can deliver high levels of growth for the next few years which should allow the bullish momentum to continue for its stock.

Alibaba (NYSE:BABA) is trying to replicate its online success in the offline retail channel. The company started using the phrase “new retail” in the last few months to signify a blending of online and offline retail through better logistics and data processing. It is now building its own physical mall in Hangzhou. This shopping center, called “More Mall,” is near Alibaba’s headquarters. It will have new retail technologies and experiences including virtual fitting rooms and makeup-testing mirrors.

Investment thesis

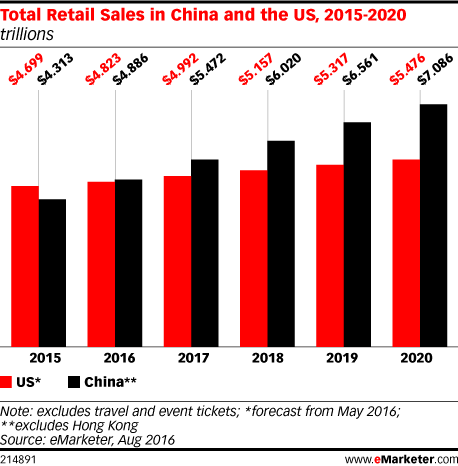

By moving into the physical retail space, Alibaba will significantly expand its total addressable market. It is important to note that Alibaba would still be following an asset-light approach in which it will leave the day-to-day management of stores to owners. Alibaba would instead focus on providing payment options, logistics support and big data analysis about customer buying preferences. It is estimated that total retail sales in China will be close to $7 trillion by 2020.

Alibaba’s rapid expansion in physical retail through a partnership with store owners should allow it to grow its GMV and revenue significantly. It also provides the company with a much longer runway for growth. Investors should not only focus on how long Alibaba can grow its online retail platform but also look at the growth potential of Alibaba’s services in physical retail stores. A back of the envelope calculation shows that if Alibaba's technology is used within 10% of physical retail sales by 2020 in China, it would add close to $600 billion in GMV. A similar commission to the online platform will provide additional revenue of close to $15 billion.

Currently, only 15% of total retail sales in China take place on the online platforms. The remaining 85% is still done through traditional brick and mortar stores. Alibaba’s management has made it clear that instead of making only incremental growth in the online space, it would also like to be a part of the remaining 85% offline sales. The company is already expanding its Hema stores which allow customers to shop, dine and order groceries according to their convenience.

Currently, only 15% of total retail sales in China take place on the online platforms. The remaining 85% is still done through traditional brick and mortar stores. Alibaba’s management has made it clear that instead of making only incremental growth in the online space, it would also like to be a part of the remaining 85% offline sales. The company is already expanding its Hema stores which allow customers to shop, dine and order groceries according to their convenience.

It has also entered into a strategic alliance with Bailian Group by acquiring 18% stake. This will allow access to 3,600 supermarkets and chain stores across the country. Through this alliance, Alibaba hopes to deliver big data analysis to retail stores.

The recent initiative to enter mall segment will allow the company to get hands-on experience into the evolving taste of customers. It will expand the addressable market for the company by attracting customers into its ecosystem who do not prefer online purchases. A strong physical retail presence is also necessary to build a good defense against other competitors.

The recent initiative to enter mall segment will allow the company to get hands-on experience into the evolving taste of customers. It will expand the addressable market for the company by attracting customers into its ecosystem who do not prefer online purchases. A strong physical retail presence is also necessary to build a good defense against other competitors.

Alibaba is in a race with rival Tencent to expand the presence of its payment platform. Alipay and Tencent’s WeChat Pay dominate the mobile payments market in China with over 90 percent market share. AliPay is one of the strongest and most promising segments of Alibaba’s businesses. Having physical stores where customers need to use Alipay instead of other options will improve long-term customer loyalty.

Core commerce still forms the backbone of Alibaba’s expanding business. The management needs to make sure that this segment has a long runway for growth and continues to deliver high revenue growth. For the current fiscal year, the management has forecasted revenue growth of 45% to 49%. A large part of this would come from its core commerce operations.

Eventually, Alibaba would like to leave the retailing business to retailers and concentrate on providing logistics, customer data, payment options, etc. This will allow the company to ramp up its presence among brick and mortar stores at a faster pace and would also be an asset-light approach. More Mall by Alibaba is slated to open in April 2018 and would provide an ideal prototype of how retailers can continue to attract customers in their physical stores.

In the last few months, Alibaba’s partners have started flexing their muscle. Alibaba manages its logistics through its affiliate Cainiao, which relies on a number of courier companies to deliver over 40 million parcels a day. One of the courier companies, SF Express - founded by China’s fourth richest man, Wang Wei – stopped providing Cainiao information about last mile delivery in May. Customer data is now one of the biggest assets for Alibaba and logistics companies.

Alibaba can use data about customer preferences to cross-sell a large variety of goods and services. If any courier company limits Alibaba’s access to customer data, it would have a huge negative impact on the company’s growth potential. A strong physical retail presence will prevent such a scenario as the retailers would need customer data from Alibaba to build their inventory and will, in turn, have to provide data about customer’s buying preferences.

Investor Takeaway

The only thing which can limit the bull run in Alibaba’s stock is investor concern about the company’s ability to grow at over 40% due to already high sales on its platform. As Alibaba moves into the physical space through its asset-light approach, it can get into partnership with retail chains to provide the payment gateway, logistic support, big data analysis and other technological support. This expands the addressable market for Alibaba significantly.

No comments:

Post a Comment