Study: Amazon, Walmart Outscore Food Retailers On Online Satisfaction

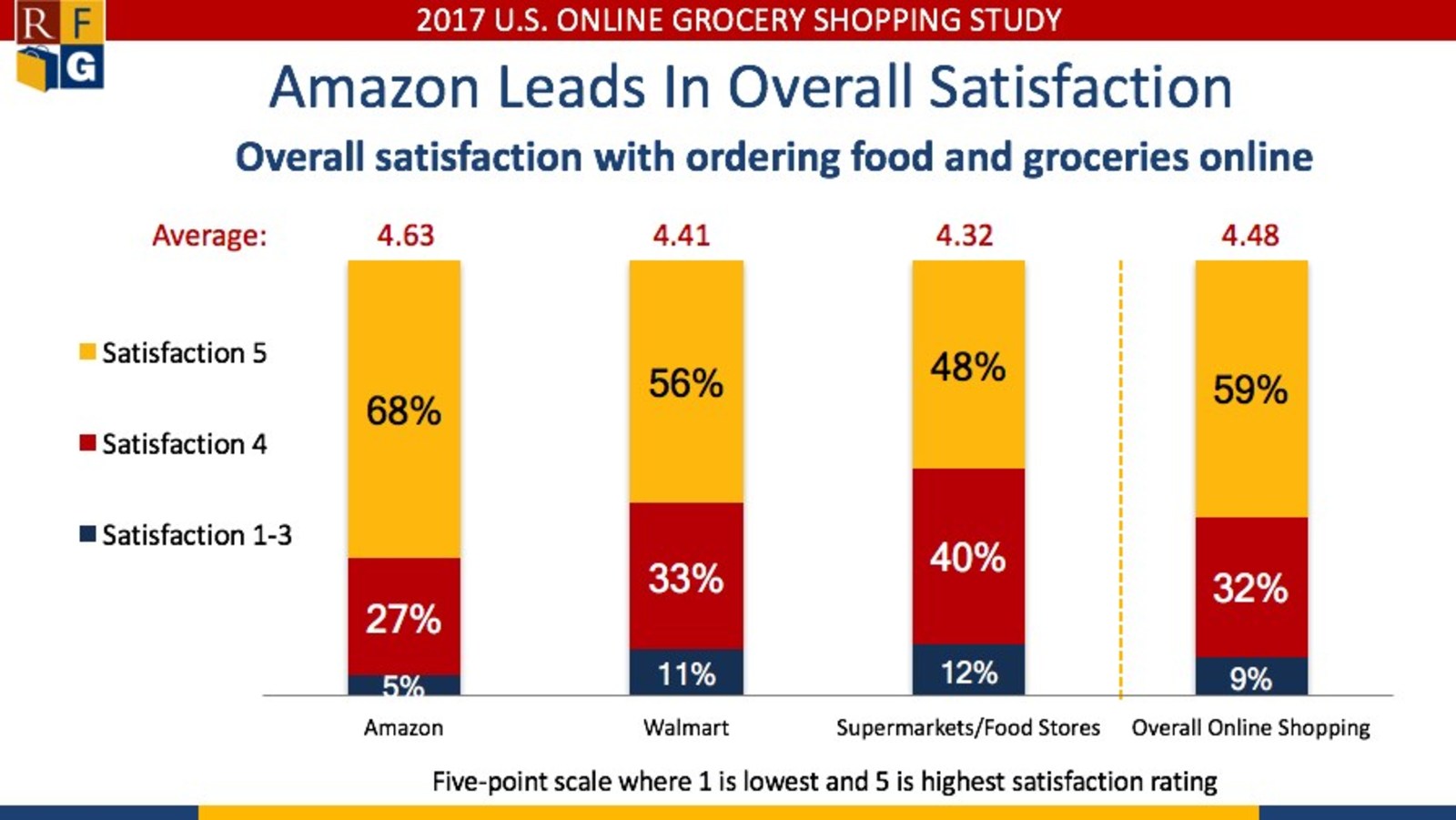

The Retail Feedback Group (RFG), a provider of actionable stakeholder feedback, has released its 2017 U.S. Online Grocery Shopper Study. This new research found about half of online shoppers plan to purchase grocery items more often in the coming year and rate their overall satisfaction ordering food and grocery items online highest with Amazon(4.63 on a five-point scale where five is highest), followed by Walmart (4.41) and supermarkets/food stores (4.32). The research also examined generational differences, finding fairly similar overall satisfaction scores across Millennials (4.50), Gen X (4.45) and Boomers (4.50).

Segmenting satisfaction scores on a variety of ordering, fulfillment and people factors, by provider, results in interesting findings, says RFG, especially when comparing those who are “highly satisfied.”

Amazon shoppers

Amazon shoppers rated nearly all of the elements of the online shopping experience significantly higher than supermarket/food store shoppers.

Amazon shoppers also rated six elements significantly higher than Walmart shoppers:

- The online checkout process worked well and without problems;

- The website/app worked smoothly during the whole order process;

- The items I wanted to buy were available on the shopping website;

- It was easy to navigate through the site/app to locate the items I wanted;

- The order pickup or delivery process was prompt and efficient; and

- The checkout staff or delivery driver was friendly.

Walmart shoppers

Walmart shoppers rated four elements significantly higher than supermarket/food store shoppers:

- The online checkout process worked well and without problems;

- It was easy to identify sale or specials prices and have those discounts applied during checkout;

- Overall I received good value for the money I paid for this order; and

- There was an available pickup time or delivery time that was convenient for me.

Supermarket/food store shoppers

These shoppers registered lower “highly satisfied” scores on nearly all elements measured versus Amazon and Walmart online grocery shoppers. There was relative parity with the other providers on just one element—the checkout staff or delivery driver was knowledgeable and professional.

“Clearly Amazon has effectively leveraged its deep roots in online retailing to inform their efforts in online grocery, leading to the strongest “highly satisfied” marks found in our research,” said Brian Numainville, RFG principal. “Walmart, although registering lower than Amazon on overall satisfaction and on several of the elements measured, also scored meaningfully higher than supermarkets/food stores in several areas core to their brand, including value, as well as identifying and receiving discounts. It appears supermarkets and food stores have work to do to improve their scores in online grocery shopping relative to these retailers.”

Online versus in-store grocery shopping

The study also sought to understand the perceived strengths of grocery shopping online versus in-store. Consumers in the study indicated that online grocery shopping strengths include making the most efficient use of their time and more convenience. On the other hand, in-store shopping strengths registered as providing products best meeting standards for quality and freshness, offering a better selection of products for shopper needs, making shoppers feel more valued as a customer, providing better customer service, showing the company knows and cares about food, and providing more value for the money spent. A few areas—including pleasantly surprising, enjoyable, and taking better care of securing payment and personal information—received more of a balanced assessment across both types of shopping.

Doug Madenberg, RFG principal, said, “While our research shows that in-store shopping currently holds a stronger position relative to online grocery shopping in quality and freshness, selection, service and value elements, brick-and-mortar retailers can’t afford to be complacent as online ordering could strive to reshape these areas in the future and negate some of these advantages. Further, retailers operating both online and in-store food retailing channels should leverage the strengths of each to their fullest advantage.”

Produce is a key factor

Shoppers who indicated anything lower than a five on the statement, “The items I received met my standards for quality and freshness” were asked to name the department(s) where quality fell short. Produce had the highest percentage of responses at 39 percent.

About eight out of ten online shoppers indicated that freshness and quality were the top factors they consider very important when purchasing produce online. Among those who do not purchase produce online, the top reasons given centered on wanting to choose produce items themselves (66 percent) or that produce items might not be fresh enough (55 percent). Interestingly, the lowest-scoring reasons given were that there was limited variety available (16 percent) or that prices might be higher than in the store (14 percent).

Grocery retailers, food distributors and media outlets can obtain a free copy of the full report at report@retailfeedback.com. The study is based on a nationally representative sample of 760 respondents who shopped online for food and groceries in the last 30 days.

The Retail Feedback Group offers a spectrum of research, consumer insight and consulting services. Its flagship program, Constant Customer Feedback (CCF), is an automated feedback platform designed and introduced for supermarket retailers, and is currently implemented in hundreds of locations across the U.S. Other RFG services include employee engagement and culture assessments, customer satisfaction surveys, consumer research and market analysis.