SUPERVALU: You Know Your Business Is In Trouble When...

Summary

Takeaways from the Q3 conference call.

Conventional grocery business remains challenged.

If you are middle of the road, you are roadkill.

SUPERVALU (NYSE:SVU) declined more than 15% Wednesday after achallenging quarter that saw competition intensify and sales decline. Q3 sales fell from $4.23 billion last year to $4.11 billion this year with same-store sales declining in all divisions, including -3.4% at Save-A-Lot.

Segment same-store sales

| Independent Business (wholesale) | -2.8% |

| Save-A-Lot | -3.4% |

| Retail Food | -2.6% |

Adjusted earnings per share of 16 cents were in line with expectations but down from 18 cents last year. Investors, however, focused on the decline in sales and market share.

In the wholesale business sales were affected by Albertsons transitioning its southeastern U.S. stores to self-distribution. Save-A-Lot (discount) and Retail Food (conventional) were affected by meat deflation but both continued to struggle to maintain share and positive traffic.

This was the weakest quarter since Sam Duncan took over the CEO post nearly 3 years ago. And certainly weakness in the S&P may have exacerbated the price decline. It is easy to kick a company when it is down, however some important comments emerged from the conference call

So let's start kicking...

Here are 5 reasons "you know your business is in trouble when"...

1. If you stop promotions for a quarter and traffic declines upwards of 4%, you know your business is in trouble:

"But that's what's been happening in retail food. We deliberately curtailed a little bit of the planned promotional activity and it's obviously affected customer traffic."

In Q4, Management intends to spend more on discounts and promotions to boost customer count. This suggests gross margins could decline and SG&A continue to rise. We should question whether this company can compete without heavy discounts and promotional pricing.

2. If you throw licensee's under the bus for weak comps, you know your business is in trouble:

"In our corporate stores, we have more discretion toward retail pricing and which items to promote, so we were able offset some of the impacts of deflation.""we have a fairly sophisticated group of merchandisers in our corporate stores that can affect retail price without impacting against our - where we see our competitors and so they have been doing a fairly effective job through the first part of this year, managing that deflation. But that's fundamentally the issue that we are faced with. The licensees have had a more difficult time as we look to what they - how their stores are performing."

Last chance to throw your business partners under the bus by implying their inferior merchandising caused same-store sales to decline greater than anticipated! Why not? In a few months the business will be spun off and you won't have to answer to them any more.

Of course, last year, when same-store sales were positive, they were more than willing to frame the message as better merchandising:

Chuck, let's start out, if you remember we've been talking for quite a while now about we're putting full cutting meat operations into Save-A-Lot. We will do it in all of the Save-A-Lot of the corporate stores with the exception of 10 or 15 because they're just not big enough to do it, but in the past the Save-A-Lot banner in the corporate stores, they were selling pre-packaged meat which was not helping the business because you can't merchandise to the specific needs of your customers in the areas that you're in. So we put in meat cutting rooms and that has been a huge impact. That's one of the biggest changes that we made.But the minute that you put it in, your business just doesn't go up because now you've got to get everybody trained and into merchandising, and that is what is happening now. As we get people trained, we're seeing the benefits of the merchandising opportunities.

3. When you blame warm weather, you know your business is in trouble:

"I would also say that there has been warmer weather across regions that we compete in and those warmer temperatures perhaps have people displacing their food consumption outside of traditional food grocery in maybe other venues."

... as opposed to admitting competition is taking share.

4. When SG&A is increasing and same-store sales declining, you know your business is in trouble:

Grocers require a significant SG&A spend to maintain operations and provide a great shopping experience: well-laid out stores, neatly stocked shelves, and fresh, high quality products, particularly produce.

At Safeway, SG&A as a percent of sales increase to 11.7% from 11.3% and total SG&A increased $8 million. The company actually had to spend more year over year despite declining sales. So despite managing better gross profit ($4 million increase) in a declining sales environment, it was more than offset by higher spending.

5. If you are a middle-of-the-road conventional grocer, you know your business is in trouble.

Management is spinning out Save-A-Lot because they believe its value will be more recognized as a separate entity. So what are SUPERVALU investors left with? A no growth retailer and distributor in a no growth segment of grocery.

Not only that, some (here, here, and here) argue much of a conventional retailers profits are a result of "slotting-fees" (or vendor allowances) from CPG's to have their products merchandised in the best spots on shelves. In a world where the middle-aisles are seeing stagnant sales as shoppers are more frequently choosing fresh and trading down to lower priced private label brands, many suppliers are questioning the value of these payments.

What would SUPERVALU earnings look like without payments from suppliers?

Final Thoughts

Many observers could look at SUPERVALU without Save-A-Lot and see a grocer that is everything to everyone yet nothing to anyone. It is neither upscale fresh grocer with a broad organic offering and high-quality produce nor is it a simple, narrowly focused discounter with low prices. It is simply a middle-of-the-road relic of another era.

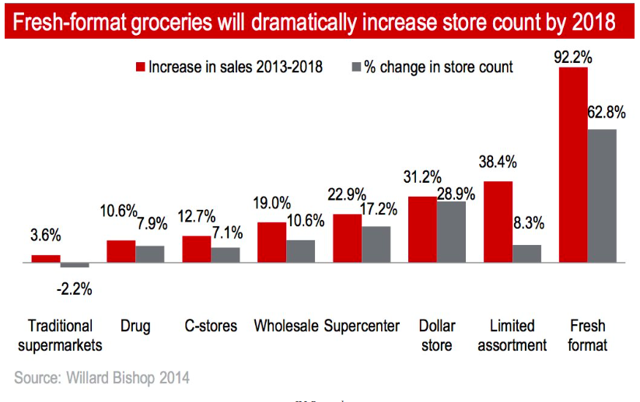

Over the last few years conventional has been the slowest growing segment: -2% YTD, +1% in 2015, -1.5% in 2014, and -2.4% in 2013. The wholesale business has also declined and remains challenged. Emerging, better run competitors continue to take share from traditional independents who, without significant scale, lack the buying power to offset flat-to-negative same-store sales with margin improvements. Any consolidation that may occur thereafter only represents further sales headwinds for wholesale.

Perhaps a fitting way to describe SUPERVALU: If you are in the middle of the road, you are roadkill.

No comments:

Post a Comment