Millennial Marketing Top Brands: Trader Joe’s Wins Big With Trade Up/Trade Down Mindset

Posted by: Bobby Golen

Millennials are taking over the market and their influence cannot be missed. Their brand preferences are quickly impacting the way all consumers interact and engage with brands.

Now in the dog days of summer, we wanted to see which brands had the most success among consumers in the first half of 2015 (prior to June 30). In partnership with YouGov, we used the BrandIndex tool to observe brand performances within a range of different categories to understand which brands are winning with millennial consumers and how these brand preferences differ from consumers 35+.

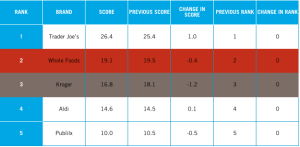

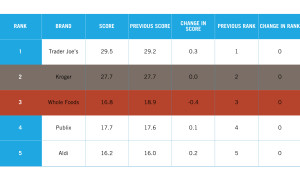

On a daily basis, BrandIndex collects consumer perceptions of 31 grocery store brands. In the first half of 2015, here is how the top five grocery store brands stacked up (highest comparative millennial index is in blue and highest consumer 35+ comparative index is in orange):

Among millennials (age 18-34):

Among consumers 35+

The Whole Foods brand is doing better among the millennial audience than it is with the consumer 35+ audience, even though it is only by half a point

Conclusion: This finding is unsurprising considering that the higher levels of affluence that millennials are quickly obtaining is putting them in the same spending category as many consumers over the age of 35 (learn more from our report Money Matters: How Affluent Millennials are Living the Millennial Dream). In fact, the Whole Foods INDEX score among affluent millennials (32.7) is significantly higher than the non-affluent millennial score (17.0).

Consumers 35+ have a more positive perception of Kroger than millennials

Conclusion: Kroger was a core grocery brand among boomers and gen X. However, with the rise of higher quality brands and the opportunity millennials are getting to buy premium products for a lower cost, options like Kroger are being pushed to the wayside for a demographic of consumers that has not grown up with a strong loyalty to the brand.

Trader Joe’s consistently snags the highest INDEX score among both millennials and consumers 35+

Conclusion: Considering the spending habits of millennials, Trader Joe’s provides an outlet where millennial shoppers are able to purchase high quality products at a more affordable price than other brands like Whole Foods. In general, Trader Joe’s is a top brand among the millennial generation, which has a large impact on consumers across the board increasing the ranking for the brand among the 35+ audiences specifically. Additionally, considering the number two and three brands, Trader Joe’s is the perfect combination of high quality products comparable to Whole Foods and low cost for that quality, pitting it against the low cost factor of Kroger.

So, what’s driving these scores?

When determining our ranking, our INDEX score is based on the average score of six core KPIs: Quality, Value, Customer Satisfaction, Reputation, General Impression, and Recommendation. What is interesting about these measurements is the difference between Value and Quality.

The Value question specifically asks, “Which of the following grocery stores do you think represents good value for money? By that we don’t mean ‘cheap,’ but that the brand offers a customer a lot in return for the price paid.” While the quality question asks, “Which of the following grocery stores do you think represents good quality?”

The intersection of these two questions is where we gain the most insight about the trade up/trade down mindset. While Whole Foods indexes extremely high in regards to Quality, Kroger is overwhelmingly the Value brand meaning millennials are trading up for Whole Foods and trading down for Kroger.

Trader Joe’s, however, has situated itself as the ultimate brand for both trading up and trading down. The Trader Joe’s private label brand is often viewed as a premium brand, aligning with discount-oriented millennials who still want to purchase quality products. At Trader Joe’s, millennials only have to trade half of their paycheck. The key for brands is to learn where their customers are trading up and where they are trading down because even as millennial affluence grows, they will continue to buy quality private label brands.

No comments:

Post a Comment