A Wal-Mart's Advantage: Blending The Clicks With The Bricks

Summary

Wal-Mart has a cost-efficient way to compete with Amazon online.

This way enables WMT to transfer shipping costs to consumers and optimize on its empty miles.

And by utilizing its vast store network and robust logistics, Wal-Mart will be able to have a competitive advantage over Amazon online.

Such news and realizations should be able to bolster investor conference in WMT and support the stock price upside momentum.

Thesis

The new trend of buying online and picking up in-store will greatly benefit retailers with robust logistic and vast store networks like Wal-Mart (NYSE:WMT).

Out of the major online options (Home delivery, in-store pickup, drive-through pickup, curbside pickup, virtual supermarket and automatic subscription), buying online and collecting in-store will be Wal-Mart's great competitive advantage over rival Amazon (NASDAQ:AMZN).

Wal-Mart's service has great potential. It will attract many consumers because it is free and flexible to consumers' busy schedules. Also, it offersWal-Mart a cost-efficient way to scale online operations because of its vast store and logistic networks, and because consumers take over the delivery costs and risks. Also, it will allow Wal-Mart to achieve significant cost savings as it optimizes on empty miles. Plus, with the click and collect system, Wal-Mart has the potential to truly become a one-stop shop both online and offline.

Introduction

At first, the fear was that everything was going to move entirely online, but that is not the case. Consumers are actually seeking for an intersection between the clicks and the bricks.

The Nielsen Global E-commerce and the New Retail Survey polled 30,000 online respondents in 60 countries to understand how digital technologies will shape the retail landscape of the future. The results were eye-opening. It found that more than half or 57% of global respondents are willing to use the "click and collect" services in the future: 57% for in-store, 55% for drive-thru and 52% for curbside pick-up.

But Nielsen is not the only company to do that research. According to the International Council of Shopping Centers' Holiday Consumer Purchasing Trends Study, nearly one-third of shoppers opted to buy products online and pick them up at the store.

These results favor a bullish case for Wal-Mart. Because it is the major retailer best positioned to benefit the most from this trend.

Benefits for Wal-Mart have already started to manifest. Based on a CNBC report on data derived from Slice Intelligence, which scans more than 3 million email receipts, WMT was the most used option for consumers who bought products online and picked them up in-store.

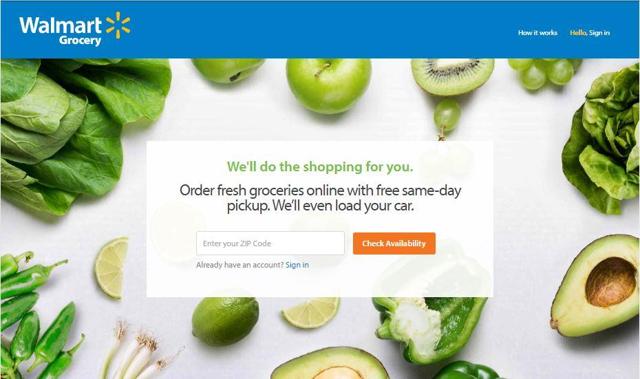

Wal-Mart's Grocery

WMT's new pickup and delivery service enables consumers to place orders online at walmart.com/grocery, choose a time slot, and orders can be loaded directly into consumers' cars at a local Wal-Mart, or in some markets, consumers can have their order delivered right to their doorstep.

With Wal-Mart, consumers can get their orders as fast as same day. Wal-Mart offers 2-4-hour windows for both pickup and delivery. Unlike delivery, pickup is always free, and Wal-Mart does not charge any monthly or annual subscription fees for this service. Making it both convenient and cost-efficient for the consumer.

By the end of this month, Wal-Mart will be offering a free grocery pickup service in ~30 locations. 90% of WMT's customers are repeat users and more than 90% of the online baskets ordered include fresh grocery items (dairy, produce or meat).

Wal-Mart's Size Advantage: Vast Store And Robust Logistics Networks

While Amazon is trying to establish more physical stores, Wal-Mart is already ahead in the bricks-and-mortar space. This is important for WMT because it has been finding a way to have a competitive edge over Amazon, and this might be it.

"We're definitely going to open additional stores; how many we don't know yet," Bezos said at the meeting according to a report from The Wall Street Journal. "In these early days, it's all about learning rather than trying to earn a lot of revenue."

Wal-Mart is better positioned to deliver a cost-efficient blend of an online experience with in-store pickup because of its vast store network. Wal-Mart has an average of ~92 stores in every state, and it is within 15 miles of 90% of Americans. According to the book, "Business Ethics in the 21st Century," 90% of all Americans live within 15 miles of a Wal-Mart. Furthermore, Wal-Mart has 11,527 total retail units, 4,601 in the U.S., 6,274 international (it is in 28 countries) and 652 are Sam's Club.

In addition, Wal-Mart has a robust logistic network and distribution centers that support scaling its online operations. The company has over 150 distribution centers. Each distribution center being more than 1 million square feet in size and ships over 200 trailers daily. With each distribution center capable of supporting 90 to 100 stores in a 150+ mile radius. Wal-Mart's robust logistic network with already established distribution centers better positions the retailer to quickly deliver to consumers at a lower cost.

Margin Expansion By Reducing "Empty Miles"

Wal-Mart has the potential to reduce "empty miles" driven and thus optimize its logistic capacity while growing sales. This can happen because as Wal-Mart scales up its online operations, it will be able to have trucks at full capacity deliver to areas in close proximity. This will reduce the chances of having a lot of "empty miles."

This is important because scaling its online operations will only make Wal-Mart's logistic network more efficient and more cost-effective. This will happen because it can use the same infrastructure, trucks and drivers to move more products. Thereby growing its top line while minimizing any cost increments. For example, last year "Wal-Mart logistics hauled over 161 million more cases while only increasing miles by 24 million, compared to last year." Consequently, Wal-Mart managed to improve efficiency of its truck fleet by 87.4% in 2014 compared to 2005. Implying that scaling its online operations will ensure that WMT is optimizing the use of its robust logistics network. Thus, creating value by reducing the "empty miles" driven.

The Trend Favors The Click And Collect System

As the willingness to use digital retailing options becomes more mainstream, the demand for online grocery shopping will become more significant.

There are a few catalysts that will help make the click and collect system more mainstream. First, consumers today are seeking fresh, natural and minimally processed foods with ingredients that have medicinal properties and that help promote good health. Meaning that collecting the produce at the store will ensure that the products are not damaged and reduce the chances of someone returning fresh produce. This is because they can check the products when they come and collect. In addition, as children born in the digital edge finish college and star families, the use of e-commerce will likely become more mainstream. This trend will also help the click and collect system to take off.

This trend is not unique to Wal-Mart. Other retailers such as Macy's (NYSE:M), Home Depot (NYSE:HD) and Kohl's (NYSE:KSS) have already attested to its potential to increase sales.

Macy's was one of the first retailers to introduce the buy-online-and-pickup-in-store option. Macy's has continued to say that buying online and picking up in-store is a service that its consumers "love and are using often." Macy's CEO said that the service is "an appointment to come in. She is going to buy. She's already made the decision. And when she does, she doesn't know this, but she's going to spend about 125% of what she intended to spend, that's just been the track record."

In addition, during Home Depot's recent great quarter, the sales potential in buying online and picking up in-store was reiterated. The company witnessed online sales growth of 21.5% for the quarter. Home Depot acknowledged that a significant portion of its sales growth is coming from the intersection of online and in-store sales.

There are also the additional purchases consumers made at Kohl's when they purchased online and came to pick-up their merchandise in-store. In November of last year, Kohl's said that 20% of the time, shoppers made additional purchases when they came to collect merchandise in-store.

I bring all these stories up to show that shopping online and picking up in-store has already taken off. The service is working from department stores to furniture stores. Consumers love the idea. There is a proven demand for it, and it is a great idea. But more than being a great idea, it is a competitive advantage for Wal-Mart over Amazon.

Conclusion

There are a few shortfalls with Wal-Mart's grocery. For instance, alcohol products may not be available for pickup at certain times and certain locations. Also, delivery is only available in select markets. Besides consumers might face additional costs if they forget to pick up their purchases. This happens because Wal-Mart reserves the right to charge a restocking fee for missed deliveries. In addition to that, the disadvantage of services such as click and collect is that they might reduce potential sales from impulse buying.

But there are greater opportunities for Wal-Mart. The company is in the best position to leverage its distribution network further. WMT can truly become the ultimate one-stop shop because it can be able to collect products it does not have in-stock from other retailers so that consumers come and collect everything at Wal-Mart.

Most importantly, it is a cost-efficient way for Wal-Mart to expand online because consumers take over the cost of getting the items from the store to their homes. If you aim to be a low-cost retailer, you will need to take up some shipping costs. For example, in FY2015, Amazon incurred over $5 billion in shipping costs. Thus, Wal-Mart will be able to avoid such exorbitant costs by transferring the cost to consumers and by optimizing its empty miles. Overtime, the click and collect system should be able to bolster investor confidence in Wal-Mart's online growth prospects.

No comments:

Post a Comment