Costco: Retail Traffic Generating Machine With Attrative Risk-Adjusted Return

Summary

Costco has one of the highest customer traffic growth in the retail sector.

Stable and modestly expanding margins provide a tailwind to EPS growth.

My price target is $190 with upside of 27% from current levels.

Costco (NASDAQ:COST) is a must-own consumer retail stock with a 1.1% dividend yield and share price upside of 27% based on my financial model.

Costco's membership fees create a unique, high margin, growing revenue stream, which matched with excelled bargains, provide some of the highest customer traffic growth in the retail sector. Because of Costco's subsidized and low margin structure, it is well insulated from eCommerce and brick-and-mortar retailers.

Key business highlights:

- An assortment of >3,500 SKUs.

- Kirkland Signature brand, a leading private-label offering.

- Membership fees range from $55/year to $110/year.

- Membership revenue is very steady and high margin, contributing about 70% of EBIT.

- Operates 698 warehouses globally (the US, Puerto Rico, Canada, the UK, Mexico, Japan, Australia, Spain, Taiwan and Korea).

- Average warehouse size is 140,000 sq/ft.

For the above listed reasons, Costco has materially outperformed the S&P 500, up 83% over the last five years versus 58% for the index.

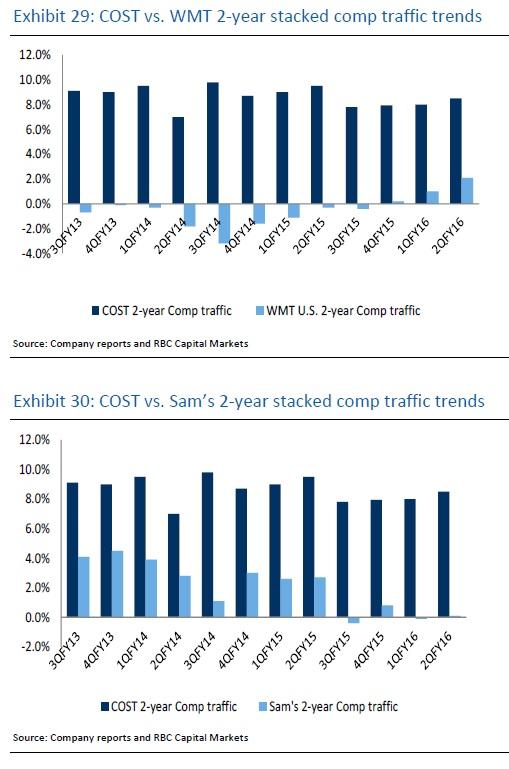

People Traffic

Costco's membership creates a unique "obligation" for people to keep coming back to justify their upfront costs. Furthermore, the high margin upfront fees allow Costco to be profitable despite very low gross margins on non-membership fee revenue. Free food, no frills, and deep discounts create a cult-like following amongst Costco shoppers. At the end of the day, Costco significantly outperforms Wal-Mart (NYSE:WMT) and Sam's in terms of traffic growth, as it continues to gain significant market share in the discount shopping segment.

Source: RBC

Assuming 8% growth in traffic based on the historical average and no signs of deceleration, we can forecast Costco's topline growth.

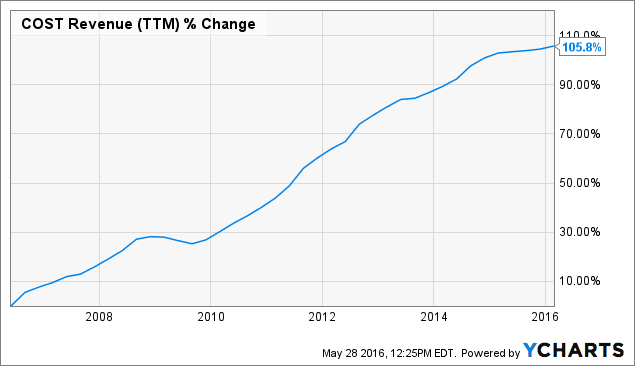

COST Revenue (TTM) data by YCharts

Over the past ten years, Costco's revenue is up over 100% which equates to a compound annual growth rate of ~15%. Growth has slowed in recent years and is now closer to ~5% year over year, which will form the trend for my financial forecast.

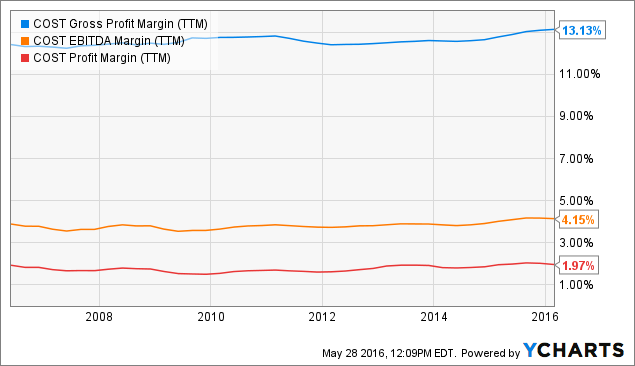

Margins

Costco has extremely stable margins. Looking back over the last 10 years, we can observe constant gross margins of 13%, EBITDA margins of 4% and net margins of 1.5-2%.

Given the stable margin profile, we can assume these margins will be maintained as the company continues to grow, which forms the basis of the financial forecast.

Valuation

COST PE Ratio (TTM) data by YCharts

Costco trades at about 28x earnings, and I am assuming no increase in P/E ratio in my target price calculation.

Below is a summary of my target price breakdown:

(Source: analysis by author)

As you can see above, I believe Costco can hit an EPS of over $6.77 in 2018 which would equate to a share price of $190, or an upside of 27%.

Key assumptions to hitting this target price include top line growth of 4-5% for the next three years and margin expansion of ~200 basis points.

Given Costco's membership fee revenue stream, high customer traffic growth, and insulation from eCommerce and brick-and-mortar retailers, I view it as a relatively low-risk opportunity to earn 27% over the next three years while being paid a 1.1% dividend yield.

No comments:

Post a Comment