I’m sure the last thing you want to read about, yet again, is another treatise on the impact of the Great Recession on the US economy. So apologies upfront. All I can say is that the effects of the recession have still not gone away. That is clear in our just released 2016 How America Shops®MegaTrends study. This national survey, conducted every two years since 1990, studies major shifts in how Americans think about and live their lives, and how and where they shop as a result.

The study, entitled “Buying Happiness”, revealed much about how shoppers are rethinking the way they spend their money and what their expectations are of retailers and brands. They are now more focused on spending to achieve a better quality of life (i.e., happiness). As a result, they now prefer to shop at places, and for categories and brands that make them feel good in multi-dimensional ways. Shoppers have a whole new value equation, which is why consistent consumer spending in everyday categories continues to disappoint in spite of improving economic indicators.

SHOPPERS FEEL MORE FINANCIALLY SECURE, BUT PURCHASING PATTERNS HAVE CHANGED.

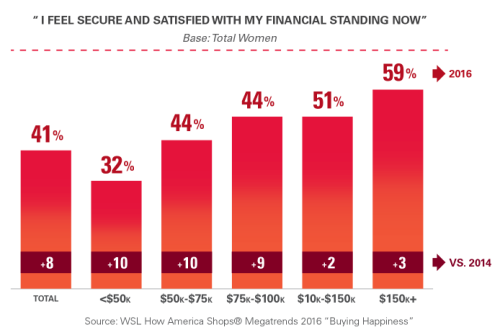

The 2016 survey showed that four-in-10 women are feeling more financially secure, an increase of eight percentage points from 2014.

They’re beginning to spend more again in 36 of the 45 categories we track (from consumables to cars, from beauty and health care to fashion, home care, pets and technology).

That said, many are not returning to spending the way they previously did. That’s because the role of buying and consumption in Americans’ lives has been permanently altered. Discretionary dollars shoppers once spent on new clothes, stocking the pantry, trying new beauty or health products, or trading up to more expensive, new improved product forms are now going elsewhere.

TRINITY OF BUYING HAPPINESS

The vestiges of the recession have left shoppers rethinking their priorities in fundamental ways. We call it their new “Trinity of Buying Happiness”:

A More Responsible Life. What makes more women feel good now is using their discretionary income to buy fiscal responsibility. Of the many ways they can spend their money, half said their #1 priority is paying off debt (55%) and saving (48%). Other spending priorities are much farther down their list: vacation (35%), hobbies (29%), buying wellness products (24%), beauty products or clothes (21% each), a nice car (19%) or getting a massage or manicure (17%). Shoppers’ new spending priorities are a revealing mix of the fiduciary, experiences and stuff.

A More Enjoyable Life. Shoppers told us they now want to live a better life, devoting more time to family and friends, staying healthy, and doing their part for the environment (e.g., saving energy and recycling).

An Easier Life. In earlier How America Shops® studies, women identified stress as their #1 health concern. So it is not surprising that they are changing their behavior and choices to make life easier. They are now finding simpler ways to take care of their home, making simpler meals, and taking care of themselves with easier, simpler beauty routines (from their hair to their skin).

Most stunning — and worrisome — is that half of shoppers said they are working to make their lives easier by spending less time shopping. (There’s another clue to retail’s dilemma). Half also said they’re spending less time on social media, and four-out-of-10 said they’re spending less time checking email and even turning off their mobile phones sometimes.

NO GOING BACK

In this study, shoppers have finally answered many of the questions American business has raised post recession:

• Question: Will the ultimate impact of the recession change American’s aspirations?Answer: Yes

• Question: Where will technology lead us, and what is its impact on retail? Answer:Its impact is/will be great, but not always how some anticipated.

• Question: Will Millennials transform shopping? Over time, will they just become like their parents? Answer: Millennials are — and will — change shopping and retail in foundational ways.

There is no going back. The immediate call to action to retailers and manufacturers is to recognize that and move on — fast.

No comments:

Post a Comment